A Booming Business Now at Risk

When former US President Donald Trump imposed tariffs on Chinese goods during his initial term, Vietnamese businessman Hao Le spotted a window of opportunity. His company, SHDC Electronics, operating from Hai Duong’s growing industrial zone, began shipping millions of dollars’ worth of phone and computer accessories to American customers.

Today, that promising growth faces a critical threat. If Trump’s proposed 46% tariffs on Vietnamese exports come into effect by July, Le says, “Our revenue could vanish overnight. It would devastate our entire business model.”

Competing in the domestic market is not a viable fallback either. “Chinese products dominate on price. Many local firms, not just ours, are struggling to maintain any foothold at home,” he adds.

From Opportunity to Uncertainty

Trump’s 2016 tariff wave redirected a flood of Chinese products—initially destined for the US—into Southeast Asia. This inflow overwhelmed local manufacturers, but also encouraged businesses to pivot into global supply chains that were eager to diversify beyond China.

Now, Trump’s proposed second-term tariff plans threaten to close those new doors. Countries like Vietnam and Indonesia, which are pushing to become tech and manufacturing leaders, may be forced to reassess their future strategies.

Caught between China—an economic giant next door—and the US—their largest export customer—these nations face an impossible balancing act.

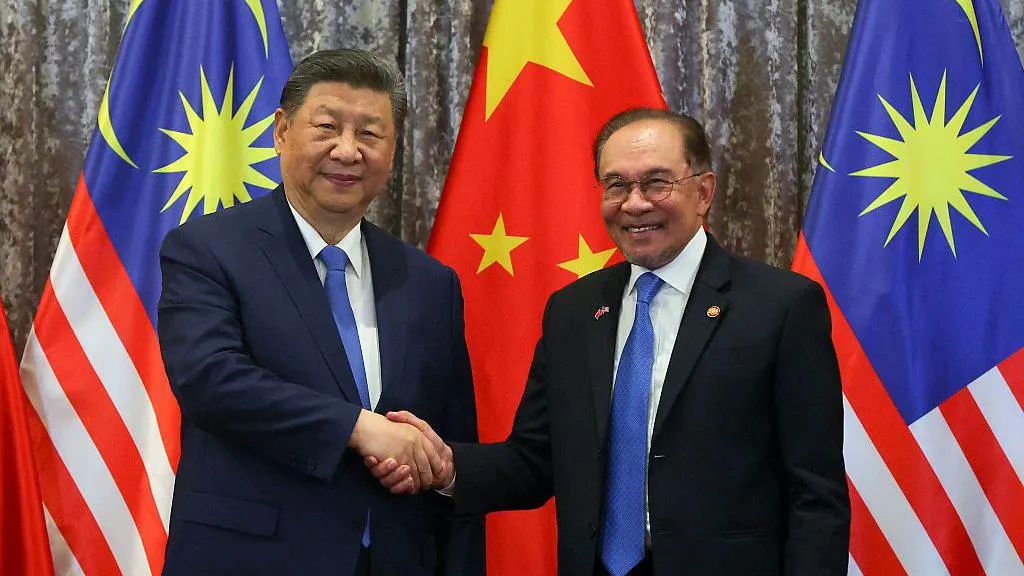

Xi Jinping’s Strategic Visit

Chinese President Xi Jinping’s recent diplomatic tour through Malaysia, Vietnam, and Cambodia is a timely one. While pre-scheduled, his message now carries urgent relevance: China is seeking unity across Asia against American protectionism.

With Southeast Asia absorbing over 16% of China’s $3.5 trillion exports in 2024, regional solidarity has become a vital economic concern for Beijing.

“We will never choose between China and the US,” said Malaysian Trade Minister Tengku Zafrul Aziz, emphasizing the country’s intent to maintain neutrality. “If our interests are threatened, we’ll protect them.”

The U.S. Remains Indispensable

Southeast Asian leaders were quick to respond to Trump’s tariff announcements. Vietnam offered to eliminate tariffs on American goods. Thailand sent delegations to Washington, highlighting the long-term strategic partnership between both nations.

“The United States is more than a market for us—it’s a partner,” said Thai Prime Minister Paetongtarn Shinawatra.

Indonesia, eyeing leadership in the electric vehicle supply chain, faces potential 32% tariffs. Malaysia, aiming to become a semiconductor hub, could be hit with a 24% tariff rate. Meanwhile, Cambodia—already heavily dependent on Chinese investment—may suffer the steepest blow: a possible 49% levy.

Even if the tariffs are paused, many believe the damage has already been done.

Small Businesses Are Feeling the Pinch

The shockwaves from Trump’s initial tariffs continue to ripple across the region. Indonesian entrepreneur Isma Savitri, who owns a sleepwear brand, is struggling to stay competitive against ultra-cheap Chinese imports that can no longer reach American markets.

“Some of our designs sell for $7. But Chinese versions go for half that. We’re being squeezed out,” she says.

Nguyen Khac Giang, a researcher in Singapore, notes: “Southeast Asia became the overflow market. These countries are hesitant to confront China, which makes them even more vulnerable.”

Industrial Fallout and Job Losses

The economic fallout is real. Over 100 factories shut down every month in Thailand over the past two years. In Indonesia, more than 250,000 garment workers were laid off after dozens of factories closed, including textile giant Sritex.

“We watched foreign goods flood our stores and destroy our local industries,” says Mujiati, a 50-year-old former Sritex employee. “After 30 years, I lost my job and don’t know who to turn to.”

Governments are now turning to protectionist measures. Indonesia proposed a 200% tariff on certain Chinese imports and blocked popular Chinese e-commerce platforms. Vietnam has twice enacted temporary anti-dumping taxes on Chinese steel. Thailand introduced stricter inspections and new import taxes for low-value goods.

China’s Diplomatic Challenge

Beijing is increasingly concerned that its strategy of redirecting exports could backfire.

“If Chinese goods flood other Asian markets and damage jobs, China could alienate its key regional partners,” says journalist David Rennie.

Territorial tensions in the South China Sea have already strained relations between China and countries like Vietnam and the Philippines. While trade has kept ties balanced, the pressure may become too great.

“Southeast Asia didn’t want to offend China,” says Chong Ja-Ian from the National University of Singapore. “But these new developments are forcing governments to reevaluate.”

New Trade Alignments Ahead?

Despite the threats, Southeast Asia may still benefit from shifts in global supply chains. Hao Le, in Vietnam, says US buyers are actively looking for alternatives to China: “Previously, supplier changes took months. Now, they happen in days.”

Malaysia, which produces nearly half of the world’s rubber gloves, is also poised to capitalize. Even if a 24% tariff is applied to Malaysian goods, that’s far better than the 145% imposed on Chinese products.

“This isn’t ideal,” says Oon Kim Hung, President of the Malaysian Rubber Glove Manufacturers Association, “but it may open the door to new opportunities for Malaysian, Thai, and Vietnamese producers.”